Beginning as an angel investor can be overwhelming, and, oftentimes, knowing where to start is the hardest part. While it can be tempting to dive head first into the vast sea of potential deals, being intentional on where to start can increase ease, interest, and potential returns. The key to finding that intentionality is through a personal investment thesis, now let’s define it.

What is an investment thesis?

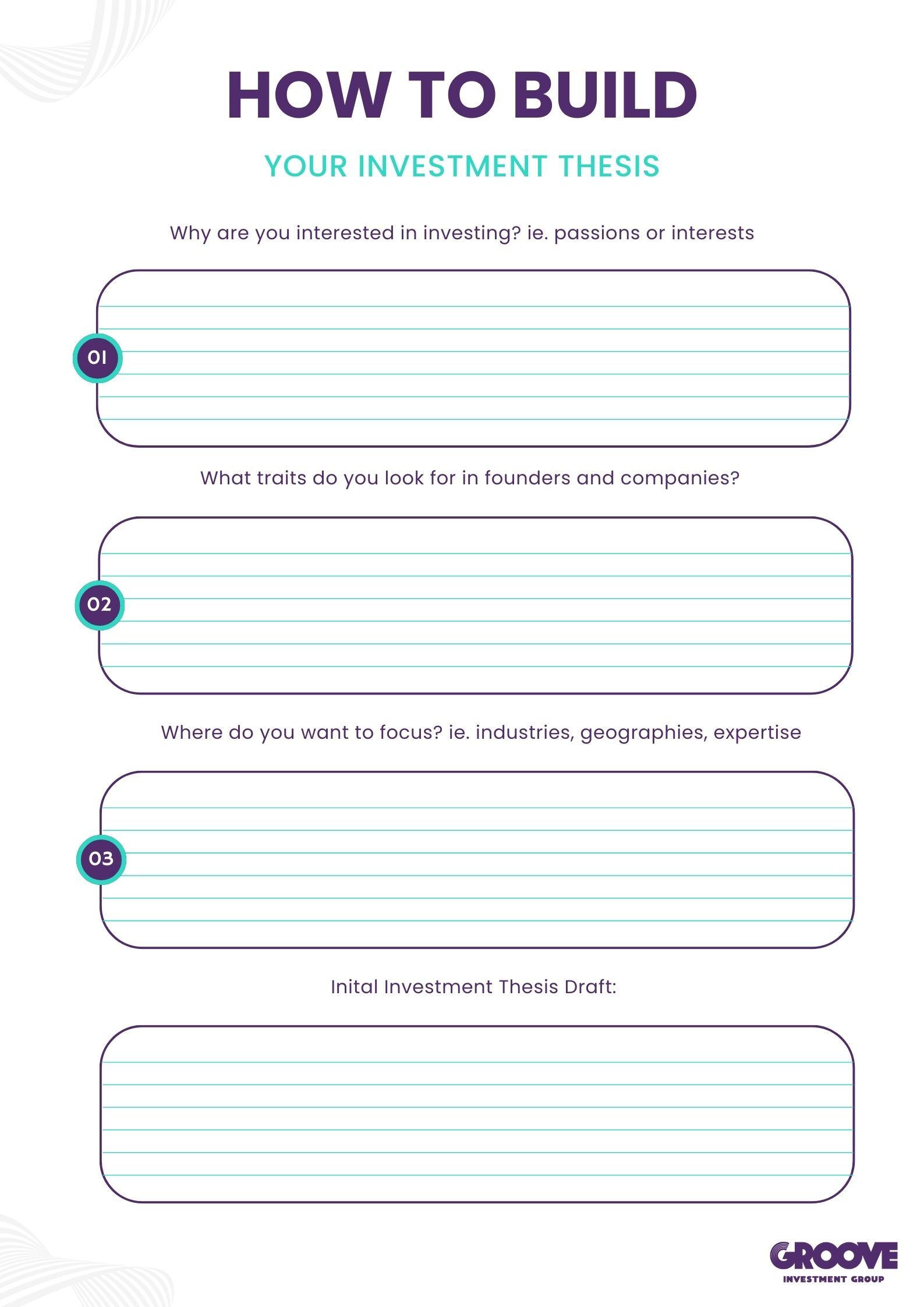

An investment thesis serves a personal guide that takes into account different factors to narrow down one's lens for potential investments. While length or breadth of a thesis is less important and entirely personal, knowing your goals, passions, interests, and focus (around founder and industry) can help define what your thesis looks like.

Here are a few questions to ask when beginning that process:

- What is driving your interest in investing?

- What are some industries you follow and are passionate about?

- Where would you say your expertise lies?

- What qualities do you look for in a good founder?

- Is there a certain minority group/founder you want to support?

- What geography do you want to be investing in?

What are some examples of thesis statements?

A few examples of investment thesis statements include:

- Broad: I invest in early and growth-stage companies who may scale effectively, are apt to dominate a given market, and display an exit potential.

- Middle Ground: I target early-stage startups led by ambitious entrepreneurs that solve problems felt by my generation. I target companies that exist in industries where I can leverage my advisor and industry expertise. I am geographically agnostic with a focus on leveraging Midwestern connections.

- Narrowed: I invest in startups that are working to reverse the negative environmental impact that governments, corporations, and individuals have on our planet. I look for scalable companies that reimagine how we live, work, and play to be more harmonious with the earth that are based in the Midwest. I prefer to invest in minority founders who are pioneering the space.

A broader thesis allows you to cast a wider net but will create difficulty in staying focused and as a result, likely waste time along the way. On the contrary, a thesis that is too narrow will limit deal flow and inhibit your ability to create a well balanced portfolio. While there is no perfect middle ground, reflecting on your own values and interests can help set a baseline parameter which will become more refined and clear over time.

How often should I revisit my thesis?

While establishing your initial thesis is the first step, in order to make sure it still aligns with your goals, passions, and expertise, it is crucial to revisit it on an annual basis. Oftentimes, your thesis will adapt with your investment experience and, therefore, the more deals you are exposed to, the better you will understand your personal values, interests, and strengths.

Pro tip: Set a date on your calendar each year as a reminder to better hold yourself accountable.

Here are a few questions that might be helpful to ask when revisiting your thesis:

- Where do you think your knowledge and interests have grown or narrowed to over the last year?

- Which geographies do most of your deals come from?

- What are your favorite investments in your portfolio and why?

- Which deals have felt the most exciting? Impactful?

- What lessons have you learned along the way?