If you're new to venture investing in Minnesota, it's imperative that you are familiar with the state's Angel Tax Credit Program; if you're looking to de-risk your investment(s) while receiving a near-term tax benefit, you'll want to make sure that your local investing activity runs through this program. The following outlines introductory information about the program, along with a brief description of what investors in a fund can expect from the process (that's within Groove Capital's Fund I or elsewhere).

After a temporary lapse in the program in 2020, it’s about to recommence in January, 2021. This is great news for investors and startups alike. But be aware, the credits available through this program are capped and are first-come-first-served. It is Groove's expectation that we're going to see pent up demand from Q3'20 and Q4'20 teams vying for credits, beyond normal fundraising activities. All the more reason to have things figured out now...

As stewards of our investors' best interests, Groove will ensure that any qualifying investments that CAN be put through this program ARE put through this program. Details on how investing via a fund works within the program can be found below, but the short of it is that we do the paperwork and you (the investor) get the benefits.

So, what is it?

The Angel Tax Credit exists to encourage investment in early stage technology startups by greasing the skids as investors consider providing funding for business owners to grow their business. Since its launch in 2010, the program has documented $418 million injected into startups within Minnesota. The credit includes:

- A 25 percent tax credit for investments in small, emerging businesses

- A maximum credit of $125,000 per person per year ($250,000 if married filing jointly)

- A state refund if credits exceed tax liability

What are the important dates to be aware of?

"For the 2021 program, $10.3 million in credits are available beginning January 4, 2021. $5.0 million of these credits are reserved for investments made in businesses 51% or more owned and managed by minorities or women or headquartered in Greater Minnesota ("targeted businesses"). If these reserved credits are not allocated by October 1, 2021, they become available for investments in any qualified business." Source.

Certification applications for individuals and funds are open.

Groove's investing will begin early 2021 to coincide with the return of the Angel Tax Credit Program. Fund investors will receive their tax credit certificates in January or February of the year following the investment.

For investors in Groove, here's what you can expect:

Groove applies for certification with the state every year the program exists. Individuals in the fund who are not planning to make their own angel investments outside of the fund DO NOT NEED to self-register with the program. By being a part of the fund, you are a part of the program for every qualifying investment made by Groove.

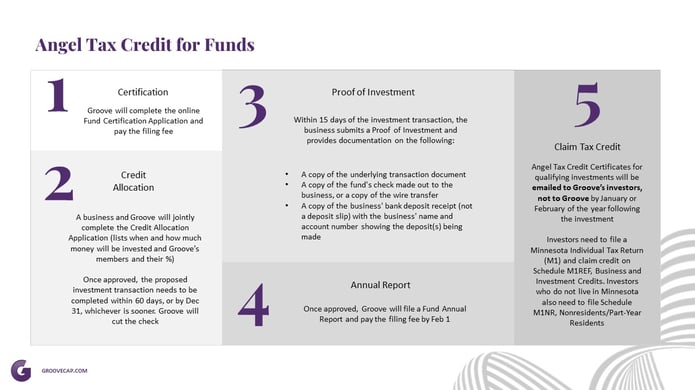

Once certified, Groove goes about its normal investing activity. When a qualifying startup is identified, Groove and the business jointly complete the Credit Allocation Application. After approval, the transaction takes place and the business submits a Proof of Investment. Groove provides a breakdown of the investors in the fund and their percent ownership of the investment to the state for the purpose of documenting individual investor credits. Shortly following the calendar year, each individual investor in the fund gets their own tax credit (and supporting documents) from the state to apply to their annual state tax filing.

The process looks a little like this:

For startups, please make sure that your company is a qualifying entity. You'll also want to ping your investors/potential investors and make sure that they are prepared to take advantage of this program.

For investors, get certified and/or make sure that your fund is certified. For those in Groove, we're on it. This is a great program, and we're happy to see it come back. Here's to better times ahead.